Previous messages

6

❤

1

🙏

1

8

7

😁

😁

🙏

1

😁

5

4

👍

2

👏

2

😁

6

❤

1

4

❤

👏

👏

1

6

👏

1

10

❤

1

🔥

1

👏

3

👌

🎉

😁

😁

🙏

8

🎉

3

❤

1

❤

5

🙏

3

❤

1

❤

💯

1

3

👍

👏

1

4

👍

8

❤

7

3

👏

😁

❤

👍

7

😁

1

8

❤

1

👌

3

👏

🙏

1

11

8

👏

4

🎉

2

4

2

❤

🔥

1

🤣

2

🎉

2

😁

5

👏

4

👍

🤣

❤

1

👏

👏

1

🍾

👍

🤣

6

👏

3

👍

2

5

👍

🍾

5

👏

2

6

❤

1

👏

1

11

❤

1

7

❤

2

5

🙏

2

👌

3

👏

2

🙏

1

👍

3

🙏

👍

4

❤

4

13

4

25

👍

11

👏

7

❤

6

😱

1

👍

❤

5

4

🤣

4

🤣

4

5

5

6

👏

5

😁

2

🔥

9

❤

1

15

❤

3

🙏

2

👏

1

4

5

😁

2

👍

😁

👍

Next messages

26 September 2024

A

JH

10:42

Jens Heitmann

In reply to this message

Hallo Andreas, hallo in die Runde,

lassen sich diese Filterkriterien auch auf den Trading View Screener übertragen?

Vielleicht kann hier jemand Hilfestellung leisten.

Vielen Dank.

Gruß

Jens

lassen sich diese Filterkriterien auch auf den Trading View Screener übertragen?

Vielleicht kann hier jemand Hilfestellung leisten.

Vielen Dank.

Gruß

Jens

NK

10:56

Nicole Keller

In reply to this message

Hallo zusammen, neue idee/gedanke: Aktie PRIM - hat den Ausbruch am 20.09. nicht geschafft, macht jetzt einen kleinen Rücksetzer, dann mal sehen wie es weiter geht. Rating >93, alle trends und performance felder positiv.

👍

MM

US

11:02

Uwe Strakeljahn

In reply to this message

Wenn es die Filtermöglichkeiten gibt, dann ist es natürlich möglich.

Man kann auch den Support von Tradingview darum bitten, den entsprechenden fehlenden Filter zu integrieren. Je mehr Personen es wünschen, desto schneller wird es dann auch umgesetzt.

Man kann auch den Support von Tradingview darum bitten, den entsprechenden fehlenden Filter zu integrieren. Je mehr Personen es wünschen, desto schneller wird es dann auch umgesetzt.

RW

MG

20:58

Mike Gottlebe

In reply to this message

Hallo Nicole, bist du beim breakout eingestiegen oder beobachtest du nur? der ausbruch hat ja zunächst geklappt am 18.9. mit schwachem volumen, 2 kerzen und 2$ später am 20.9. der rücksetzer und genau jetzt befinden wir uns wieder auf ausbruchsniveau. möglich, dass jetzt ein stärkerer impuls nach norden kommt, aber aktuell drängt sich diese annahme nicht auf. wenn du noch nicht eingesteiegn bist, dann würde ich warten ob und wie der kurs die 60$ kassiert (oder eben nicht)

NK

21:01

Nicole Keller

In reply to this message

vielen dank für deinen Input! Ich bin nicht eingestiegen auf grund von heutigen börsenterminen, aber beobachte. mal sehen wasmorgen passiert :) habe mir einen alarm für das hoch bei 60 gesetzt :)

👍

CM

A

22:26

Andreas

In reply to this message

Bis jetzt alles im grünen Bereich, die Aktie ist noch in der Kaufzone, aucxh wenn der Umsatz am Breakout-Tag 17.09. lt. IBD schwach war. In der aktuellen Gesamt-Markt-Phase sind so ziemlich alle Breakouits sehr zäh unterwegs, es fehlt eben der Rückenwind.

Die 60-Dollar-Marke kann auch ein stärkerer Widerstand sein, als man meinen mag. Runde Kursmarken können schon mal wie ein Deckel wirken, wenn die Aktie nicht direkt beim ersten Anlauf mit Dynamik nach oben durchbricht. Die Aktie hat aber erst ein mal die 60 USD touchiert, also noch kein wirkliches Problem.

🙏

Die 60-Dollar-Marke kann auch ein stärkerer Widerstand sein, als man meinen mag. Runde Kursmarken können schon mal wie ein Deckel wirken, wenn die Aktie nicht direkt beim ersten Anlauf mit Dynamik nach oben durchbricht. Die Aktie hat aber erst ein mal die 60 USD touchiert, also noch kein wirkliches Problem.

NK

A

23:02

Andreas

‼️Achtung - Achtung - Achtung ‼️

Da die IBD-Philosophie eine sehr gute Ergänzung zu LURO ist und wir uns immer häufiger hier darüber austauschen, habe ich einfach mal bei IBD angefragt, ob man uns für die Premium-Software „MarketSurge“ ein Sonderangebot zum ausprobieren machen kann - und ja, man kann: Ihr könnt die Software, die normalerweise 149,95 USD + MwSt. pro Monat kostet, 8 Wochen lang für 59,95 USD + MwSt. vollumfänglich testen, dazu gehört auch jede Menge Schulungsmaterial. Das Angebot gilt für neue oder wiederkehrende Benutzer, d.h. man darf die Software in den letzten 6 Monate nicht als Trial genutzt haben.

Die Software ist sehr umfangreich und man muss sich wirklich Zeit dafür nehmen. Ein bisschen am Smartphone rumdaddeln auf dem Weg zur Arbeit reicht nicht aus, um die Möglichkeiten zu entdecken.

Wenn mind. 5 bis 6 Benutzer das Angebot annehmen, kann ich auch gern mal eine Zoom-Session nur für „MarketSurge“ und eine Tour durch die Highlights machen sowie Fragen beantworten.

Für das Angebot und die Zoom-Session bekomme ich kein Geld oder andere Bonifikationen, es ist also eine ehrliche Empfehlung. Ich mache das, weil ich IBD-Fan bin und gerne andere davon begeistern möchte.

Wer ernsthaftes Interesse hat, bitte bis zum Wochenende als private Nachricht bei mir melden.

Happy profit´s

Andreas

👍

Da die IBD-Philosophie eine sehr gute Ergänzung zu LURO ist und wir uns immer häufiger hier darüber austauschen, habe ich einfach mal bei IBD angefragt, ob man uns für die Premium-Software „MarketSurge“ ein Sonderangebot zum ausprobieren machen kann - und ja, man kann: Ihr könnt die Software, die normalerweise 149,95 USD + MwSt. pro Monat kostet, 8 Wochen lang für 59,95 USD + MwSt. vollumfänglich testen, dazu gehört auch jede Menge Schulungsmaterial. Das Angebot gilt für neue oder wiederkehrende Benutzer, d.h. man darf die Software in den letzten 6 Monate nicht als Trial genutzt haben.

Die Software ist sehr umfangreich und man muss sich wirklich Zeit dafür nehmen. Ein bisschen am Smartphone rumdaddeln auf dem Weg zur Arbeit reicht nicht aus, um die Möglichkeiten zu entdecken.

Wenn mind. 5 bis 6 Benutzer das Angebot annehmen, kann ich auch gern mal eine Zoom-Session nur für „MarketSurge“ und eine Tour durch die Highlights machen sowie Fragen beantworten.

Für das Angebot und die Zoom-Session bekomme ich kein Geld oder andere Bonifikationen, es ist also eine ehrliche Empfehlung. Ich mache das, weil ich IBD-Fan bin und gerne andere davon begeistern möchte.

Wer ernsthaftes Interesse hat, bitte bis zum Wochenende als private Nachricht bei mir melden.

Happy profit´s

Andreas

CK

PB

RS

27 September 2024

NS

07:36

Nicola Siebert

Guten Morgen zusammen 😃,

das neue YouTube-Video ist heute online gegangen.

Thema heute - auf Wunsch von Klaus:

Bracket Order dauerhaft automatisch an Option Trade anhängen - in der TWS - einfach und kurz erklärt

Wenn Du KEINE LUST haben solltest, jedes Mal händisch eine Bracket- oder OCA-Order an Deine Option anzuhängen, dann hast Du die Möglichkeit, dieses automatisiert von der TWS machen zu lassen.

Die Step-by-Step-Anleitung erhältst Du im Video.

Und ein kleiner Ausblick für nächsten Freitag:

Wenn alles so läuft wie geplant, wird es - auf vielfachen Wunsch hin - eine ausführliche Einführung/Erklärung zum Aktienscreener 2.0 von TradingView geben.

Herzliche Grüße und Euch allen ein großartiges Wochenende.

Nicola

👍

das neue YouTube-Video ist heute online gegangen.

Thema heute - auf Wunsch von Klaus:

Bracket Order dauerhaft automatisch an Option Trade anhängen - in der TWS - einfach und kurz erklärt

Wenn Du KEINE LUST haben solltest, jedes Mal händisch eine Bracket- oder OCA-Order an Deine Option anzuhängen, dann hast Du die Möglichkeit, dieses automatisiert von der TWS machen zu lassen.

Die Step-by-Step-Anleitung erhältst Du im Video.

Und ein kleiner Ausblick für nächsten Freitag:

Wenn alles so läuft wie geplant, wird es - auf vielfachen Wunsch hin - eine ausführliche Einführung/Erklärung zum Aktienscreener 2.0 von TradingView geben.

Herzliche Grüße und Euch allen ein großartiges Wochenende.

Nicola

CK

TW

M

A

D

A

17:16

Andreas

In reply to this message

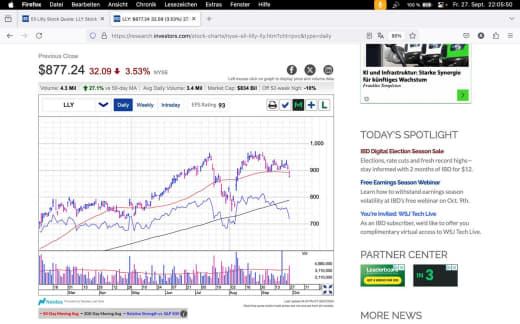

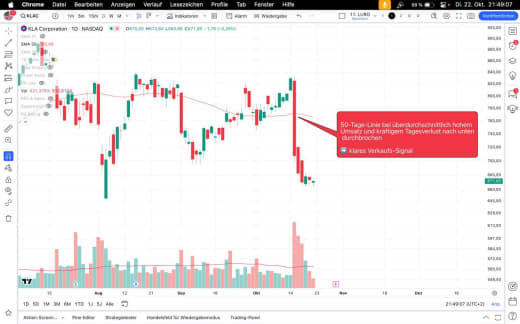

LLY: fällt gerade mit hohem Volumen unter den SMA 50 - kein gutes Zeichen

😢

FW

NK

17:17

Nicole Keller

In reply to this message

Ziehst du daraus auch schlüsse auf den gesamtmarkt? Oder ist dein Kommentar „kein gutes zeichen“ allein auf lly bezogen?

👍

BM

A

17:36

Andreas

In reply to this message

auf LLY, weil dieses Szenario ein typisches Sell-Signal ist. Bestätigt aber auch ein bisschen den eher flauen Gesamtmarkt

US

18:00

Uwe Strakeljahn

In reply to this message

UHS aus dem Health Sektor ist auch stark am fallen. Aber der Sektor selbst XLV ist noch am steigen.

_

18:23

_Schnuff Handy

In reply to this message

Hallo Nicola, kurz und knackig! Vielen Dank für das Video! Eine Nachfrage. Kann man die Bracket Order auch für Options-Combos einstellen? Also z.B. für einen Bull put Spread? Ich mache das immer recht umständlich und fände es prima, wenn man das voreinstellen könnte. Lg Heidi

👍

EH

MW

UH

19:33

Ulrich H

In reply to this message

Heißt das, dass es weiter nach unten geht oder dass es länger zur Erholung braucht?

NK

20:05

Nicole Keller

In reply to this message

Andreas ich muss jetzt nochmal ganz doof nachfragen - wo siehst du denn da das hohe volumen mit dem fall?

👏

UH

A

21:34

Andreas

In reply to this message

fein, fein, Du denkst mit und fragst nach 👏👏👏

Links oben unter dem Namen steht das aktuelle Handelsvolumen und in Klammern die entsprechende Veränderung zum Durchschnitt. Bei IBD wird dieser Wert in Klammern immer in Relation zum Durchschnittsumsatz zur etwa gleichen Tageszeit berechnet, so dass man aktuell davon ausgehen kann, dass zum Handelsende der Gesamtumsatz höher als der Durchschnitt sein wird, sofern der Handel nicht plötzlich abreißt. Ich hoffe, ich hab das verständlich erklärt, hier noch mal der aktuelle Chart ⬇️⬇️⬇️

🙏

Links oben unter dem Namen steht das aktuelle Handelsvolumen und in Klammern die entsprechende Veränderung zum Durchschnitt. Bei IBD wird dieser Wert in Klammern immer in Relation zum Durchschnittsumsatz zur etwa gleichen Tageszeit berechnet, so dass man aktuell davon ausgehen kann, dass zum Handelsende der Gesamtumsatz höher als der Durchschnitt sein wird, sofern der Handel nicht plötzlich abreißt. Ich hoffe, ich hab das verständlich erklärt, hier noch mal der aktuelle Chart ⬇️⬇️⬇️

NS

SB

NK

21:36

Nicole Keller

In reply to this message

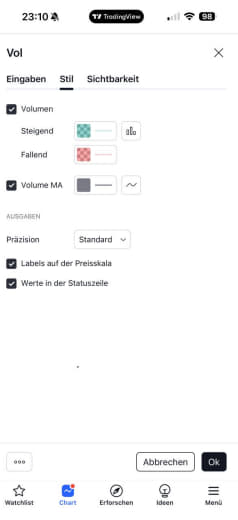

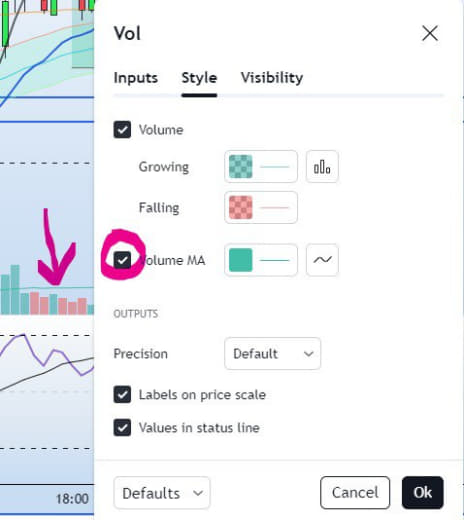

Super andreas danke! ja das habe ich verstanden. weiss jemand zufällig, ob die veränderung zum durchschnitt auch bei Trading view einzustellen geht?

21:37

In reply to this message

bei mir sieht das volumen der heutigen kerze bei LLY so aus - ohne angabe "veränderung zum durchschnitt"🧐

A

A

22:06

Andreas

In reply to this message

Vom Wert 3,2 Mio. passt es ja, nur kann Tradingview diesen Wert nicht in Relation zum Durchschnitt setzen. Bei den frei verfügaren Charts auf IBD bekommt man das Volumen auch in Relation zum SMA 50 angezeigt. ⬇️⬇️⬇️

🙏

NK

NK

A

22:13

Andreas

In reply to this message

Auf der Startseite von finviz wird das Handelsvolumen der Indices auch links im Bild als relatives Volumen angezeigt.

NK

22:15

Nicole Keller

In reply to this message

das würde für die gesamtmarktbetrachtung helfen, für die beurteilung des big pictures, wie du es schriebst "volumen höher oder tiefer zum vortag"?

👍

A

US

22:25

Uwe Strakeljahn

In reply to this message

Das Volumen einer Aktie kann man nur wenig Gewicht gegenüber einem Index gegenüber stellen. Das ist wie Äpfel mit Kirschen gleichzusetzen. Interessant ist das Verhältnis zu den Vortagen, bzw. auf niedrigeren Zeiteinheiten zu den vorherigen Kerzen. Das lässt sich gut mit Volumenkerzen darstellen.

MG

22:40

Mike Gottlebe

Welcher ticker ist das?

NK

A

22:50

Andreas

In reply to this message

Ich denke das hat Nicole auch nicht gemeint, also das Volumen eines Index mit einer Aktie zu vergleichen. Es geht um den Umsatz der Aktie oder des Index gegenüber den Vortagen, Durchschnitt usw.

A

23:19

Andreas

In reply to this message

Die Wahrscheinlichkeit, dass der Abwärtstrend gebrochen ist, wird durch den Ausbruch nach oben größer, aber es gibt keine Garantie dafür, dass die Aktie jetzt fleißig nach oben marschiert, d.h. man hat "nur" einen statistischen Vorteil für den Aufwärtstrend.

By the way: Spiel-Casino´s haben im Roulette bei den Wetten auf schwarz oder rot lediglich einen Hausvorteil von ca. 2,7 % durch die grüne Null, d.h. das Casino muss die Spieler nur lange genug am Tisch halten, um auf jeden Fall Geld zu verdienen.

An der Börse ist das ähnlich, jeder kleine Vorteil verbessert die Chancen auf einen Erfolg.

By the way: Spiel-Casino´s haben im Roulette bei den Wetten auf schwarz oder rot lediglich einen Hausvorteil von ca. 2,7 % durch die grüne Null, d.h. das Casino muss die Spieler nur lange genug am Tisch halten, um auf jeden Fall Geld zu verdienen.

An der Börse ist das ähnlich, jeder kleine Vorteil verbessert die Chancen auf einen Erfolg.

28 September 2024

A

09:35

Andreas

Hallo alle Zusammen, wie ist Eure Börsenstimmung für die Wall Street aktuell?

Bitte nur abstimmen, nicht kommentieren. Let's go!

Bitte nur abstimmen, nicht kommentieren. Let's go!

Final results

- eher bullish 👍 28 votes

- eher neutral oder seitwärts ⚖️ 37 votes

- eher bearish 👎 8 votes

- ich kann mich nicht entscheiden 🫣 5 votes

78 votes

NS

11:42

Nicola Siebert

In reply to this message

Hallo liebe Heidi 😃,

vielen Dank für das schöne Kompliment 🙏, dass motiviert mich immer wieder aufs neue doch weiterzumachen.

Bzgl. Deiner Frage bin ich tatsächlich auch noch immer auf der Suche, weil auch mich die umständliche Eingabe in der TWS stört. Deswegen nutze ich für Combos grundsätzlich die Handy-App - mit der es super einfach und schnell geht.

Sobald ich eine Lösung gefunden habe, werde ich aber sehr gerne sofort ein Video dazu anfertigen.

Oder hat hier in der Gruppe jemand vielleicht eine Lösung und kann uns "aufklären"?

Herzliche Grüße und Euch allen ein schönes und vor allem erholsames Wochenende.

Nicola

vielen Dank für das schöne Kompliment 🙏, dass motiviert mich immer wieder aufs neue doch weiterzumachen.

Bzgl. Deiner Frage bin ich tatsächlich auch noch immer auf der Suche, weil auch mich die umständliche Eingabe in der TWS stört. Deswegen nutze ich für Combos grundsätzlich die Handy-App - mit der es super einfach und schnell geht.

Sobald ich eine Lösung gefunden habe, werde ich aber sehr gerne sofort ein Video dazu anfertigen.

Oder hat hier in der Gruppe jemand vielleicht eine Lösung und kann uns "aufklären"?

Herzliche Grüße und Euch allen ein schönes und vor allem erholsames Wochenende.

Nicola

s

12:01

schadn

Dann mach doch ein Video bzgl Handy App😂

👍

A

CK

EH

_

21:13

_Schnuff Handy

In reply to this message

Hallo Nicola,

ich stelle das Limit für die Prämie beim BUPS immer ca. 20$ höher ein und klicke auf übermitteln. Dann hat man im Nachhinein über die rechte Maustaste Zeit und Möglichkeit, die Bracket Order einzustellen. Ist nicht die charmanteste Lösung, aber sie funktioniert… 😉

Lg Heidi

ich stelle das Limit für die Prämie beim BUPS immer ca. 20$ höher ein und klicke auf übermitteln. Dann hat man im Nachhinein über die rechte Maustaste Zeit und Möglichkeit, die Bracket Order einzustellen. Ist nicht die charmanteste Lösung, aber sie funktioniert… 😉

Lg Heidi

29 September 2024

A

09:56

Andi

Guten Morgen Zusammen,

hat einer von euch auch Probleme mit dem Update der TWS? Seit dem ich beim MacBook das neue Betriebssystem habe, lässt sich die TWS nicht mehr Updates und nicht öffnen.

Vielleicht hat ja jemand einen Tipp. Danke vorab und einen schönen Sonntag ☀️

👍

hat einer von euch auch Probleme mit dem Update der TWS? Seit dem ich beim MacBook das neue Betriebssystem habe, lässt sich die TWS nicht mehr Updates und nicht öffnen.

Vielleicht hat ja jemand einen Tipp. Danke vorab und einen schönen Sonntag ☀️

E

US

10:01

Uwe Strakeljahn

In reply to this message

Das Problem mit den MacBooks kommt immer wieder hoch. In der PJM-Community hat wohl einer schon eine Lösung gefunden. Wenn du vielleicht dort mal nachschaust.

Übrigens bei Microsoft-Rechnern gab es diese Probleme wohl noch nie.

🙏

Übrigens bei Microsoft-Rechnern gab es diese Probleme wohl noch nie.

A

A

A

10:34

Andi

Kurz zusammengefasst: Deinstallation und Neuinstallation hat geholfen 🙂

A

13:41

Andreas

In reply to this message

Ich hab die Neuinstalltion einfach drübergebügelt, reicht auch. Wichtig: vorher das Layout auf der eigenen Festplatte sichern, damit man es auf der Neuinstallation importieren kann.

13:48

In reply to this message

Aua, noch nie Probleme unter Fenster von Miniweich? Das bezweifel ich aber hart!

Und wer zum Henker nennt sein Betriebssystem "Fenster"? Vermutlich damit man im Falle eines Blue-Screens direkt eine Eselsbrück zum nächsten to do hat: Blue-Screen-> Fenster-> aufmachen-> rausschmeißen! 😜

Und wer zum Henker nennt sein Betriebssystem "Fenster"? Vermutlich damit man im Falle eines Blue-Screens direkt eine Eselsbrück zum nächsten to do hat: Blue-Screen-> Fenster-> aufmachen-> rausschmeißen! 😜

US

13:55

Uwe Strakeljahn

In reply to this message

Tja wer seine Fenster immer schön putzt mit einem Miniweichen Tuch der hat auch den vollen Durchblick.

In dem einen oder anderen Apfel steckt schon mal ein Wurm🤣

👏

In dem einen oder anderen Apfel steckt schon mal ein Wurm🤣

MG

A

A

T

18:08

Thomas

Hallo zusammen, mein Avast One, Anti Vieren Programm hat den TWS updater.exe blockiert, weil mit IDP.Generic infiziert....Soll ich da eine Ausnahme machen oder in der Quarantäne erst mal belassen.

A

MG

18:44

Mike Gottlebe

Ich bin ja auch Mac Nerd und war schwer beleidigt, als unser sohnemann kürzlich seinen schnuckeligen Mac mini gegen einen „Gaming pc“ tauschen wollte. Seit dieser mikrowellengroße Trümmer mit integrierter stadionbeleuchtung allerdings hier steht, freue ich mich schon auf die nächste gasrechnung, denn wie es aussieht , werden wir diesen Winter das gesamte Haus mit dem Ding beheizen können 😎 aber vermutlich frisst das die Stromrechnung gleich wieder auf 🙈

👍

T

PB

18:56

Patrick B.

Weils einfach gerade total dazu passt will ich meinen Senf auch noch dazu geben 😂

Ich bin absoluter Techniknerd und möchte alles testen und probieren. Ich bin weder gegen das eine noch gegen das andere…

Mein Laptop kam in die Jahre und ich wollte einfach mal spaßeshalber die Applevariante probieren. Also in den Apple Store und ein MacBook gekauft. Geendet hat es mit dem Verkäufer, dem Store Manager und einer Security (lange Geschichte 😂)

Ne Woche später war ich nochmal dort und das gleiche Spiel nochmal.

Letztenendes habe ich jetzt so ne Kiste daheim und ich gebe mir echt Mühe das zu integrieren… Ich habe aber NIE so ein inkompatibles Kack System gesehen wie Apple!!! Docking Station, Monitore und selbst der Sound funktioniert nicht auf anhieb…

Soviel von meiner Seite das Wort zum Sonntag 😂

👏

Ich bin absoluter Techniknerd und möchte alles testen und probieren. Ich bin weder gegen das eine noch gegen das andere…

Mein Laptop kam in die Jahre und ich wollte einfach mal spaßeshalber die Applevariante probieren. Also in den Apple Store und ein MacBook gekauft. Geendet hat es mit dem Verkäufer, dem Store Manager und einer Security (lange Geschichte 😂)

Ne Woche später war ich nochmal dort und das gleiche Spiel nochmal.

Letztenendes habe ich jetzt so ne Kiste daheim und ich gebe mir echt Mühe das zu integrieren… Ich habe aber NIE so ein inkompatibles Kack System gesehen wie Apple!!! Docking Station, Monitore und selbst der Sound funktioniert nicht auf anhieb…

Soviel von meiner Seite das Wort zum Sonntag 😂

D

18:57

Wenn ich die ganze Story schreiben würde, würde keiner verstehen wie dieses Unternehmen so erfolgreich sein kann … vom Verlauf über den Kundenservice war unter aller Sau und jedes andere Unternehmern würde schon lange pleite gehen … nur weil da ein Apfel drauf ist stürmen die Menschen diese kack Läden 😅

18:58

Aktuell versuche ich Täglich dieser Kiste eine Chance zu geben … mein Bauch sagt aber „Gib das Ding bitte zurück und Kauf dir einen gescheiten Rechner für das Geld!“ 🙈

RW

19:00

Rebecca Waizenegger

😂 Patrick ich finde deine Stories immer wieder klasse

Ich hab deswegen einfach beides. Windows UND Apple. Und den Rest mach ich mit Google 🤣🤣🤣

🤣

Ich hab deswegen einfach beides. Windows UND Apple. Und den Rest mach ich mit Google 🤣🤣🤣

PB

PB

19:01

Patrick B.

Und als positiven Abschluss: Ja, wenn man Watch, iPhone, iPad, AirPods und MacBook hat ist das Zusammenspiel der Wahnsinn und beispiellos… Aber die Welt ist nunmal auf Windoof zugeschnitten 😂

19:03

In reply to this message

Ich habe auch das Glück beides zu haben. Aber das MacBook war neu für mich … und die Chancen stehen schlecht fürs behalten 😂

US

19:03

Uwe Strakeljahn

In reply to this message

Ich nutze das russische Antivirenprogramm. Da habe ich noch nie Probleme mit gehabt. Ist Avast One eine kostenlose Version?

Ich habe schon von anderen Nutzern dieser Antivirensoftware gehört, dass es Programme blockiert, die tatsächlich aber Virenfrei sind.

Ich habe schon von anderen Nutzern dieser Antivirensoftware gehört, dass es Programme blockiert, die tatsächlich aber Virenfrei sind.

19:08

Ich habe auch noch ein Apple IPad. Neuere Software lässt sich aber nicht mehr laden und überarbeitete Software funktioniert auch nicht mehr. Man wird dann gezwungen ein neueres Modell zu kaufen.

MG

19:45

Mike Gottlebe

…Oder auf einen alten Gerät einfach nicht das neueste OS installieren. So ist das nun mal. Nicht nur bei Apple.

US

A

21:15

Andreas

In reply to this message

das liegt sicher an DEINER Einstellung und nicht an denen der Geräte 😉

21:17

äähh, nein! An Apple a day keeps the doc away!

21:19

In reply to this message

Russisches Antiviren-Program, wie süß.

Wenn der Glaser keine Aufträge mehr hat, schickt er seine Kinder los Steine zu schmeißen.

Wenn der Glaser keine Aufträge mehr hat, schickt er seine Kinder los Steine zu schmeißen.

21:21

In reply to this message

Das nennt sich proaktiver Offlineverkauf, der blendend funktioniert, sogar ohne KI. 😂

US

21:27

Uwe Strakeljahn

In reply to this message

Nur nicht bei mir. Bei mir wird das IPad erst ausgetauscht, wenn es Hardwaretechnisch (z.B. defekter Akku) defekt ist. Was Konsum betrifft, war ich schon mein Leben lang sehr sparsam aber nicht geizig.

A

21:46

Andreas

Aber jetzt mal ehrlich, wir werden doch von allen Marken früher oder später über den Tresen gezogen: BMW hatte jahrelang Probleme mit der Fahrzeugelektronik, Mercedes aktuell massive Qualitätsprobleme und bei Tesla sieht's auch nicht anders aus. Fußballfans wird seit Jahren mit völlig überteuerten Fanartikeln das Geld aus der Tasche gezogen und auch die Bundesregierung ist nicht mehr wert als Azubi-Gehälter. Und dann noch die größte Firma der Welt, die katholische Kirche: seit über 2.000 Jahren sacken die das Geld der kleinen Leute ein und führen für ihre Gier Kriege. Und Jesus der Lump hängt da einfach nur rum und sieht zu.

Für all das gibt es nur eine Lösung: finanzielle Freiheit! Verschenkt Eurer ganzes Hab und Gut, bis auf die Hose und das T-Shirt was Ihr anhabt und zieht für den Rest Eures Lebens in eine Gegend, wo man kein Geld braucht. Zack, Probleme erledigt.

Und wer Hilfe bei der Entsorgung seines Geldes braucht, dem kann ich auch ganz persönlich zu Seite stehn. 😁

❤

Für all das gibt es nur eine Lösung: finanzielle Freiheit! Verschenkt Eurer ganzes Hab und Gut, bis auf die Hose und das T-Shirt was Ihr anhabt und zieht für den Rest Eures Lebens in eine Gegend, wo man kein Geld braucht. Zack, Probleme erledigt.

Und wer Hilfe bei der Entsorgung seines Geldes braucht, dem kann ich auch ganz persönlich zu Seite stehn. 😁

UH

OB

PB

21:58

Patrick B.

In reply to this message

Wie so häufig sprichst du mir aus der Seele 😂

100% Zustimmung 😁

100% Zustimmung 😁

US

22:08

Uwe Strakeljahn

Ich bin ein wenig dem System entflohen, indem ich meine Arbeitskraft als Ingenieur an den Nagel gehangen habe. Jetzt zahle ich nur noch einen kleineren Teil des Geldes in das System. Ich bezeichne mich selbst als A-Sozialer. Aber ich nehme nicht Geld von anderen Steuerzahlern an.

Die Erde dreht sich weiter, gefühlt etwas schneller und mit dem Drang in eine andere Richtung.

Die Erde dreht sich weiter, gefühlt etwas schneller und mit dem Drang in eine andere Richtung.

30 September 2024

AH

A

MG

15:22

Mike Gottlebe

15:22

70% auf premium

❤

M

s

15:38

Plus ist hier günstiger

👏

SB

E

FN

21:16

Frank Neumaier

Ich habe das Premium abgeschlossen, mit der Autocharterkennung. Die kann auch Tasse mit Henkel erkennen und Alarme generieren. Hat da jemand Erfahrung damit? Passen die Standardeinstellungen dafür?

RT

21:31

Robin Trapp

In reply to this message

Leider habe ich erst vor kurzem das Trial von IBD selbst ausprobiert, sonst hätte ich bei deinem Angebot zugeschlagen!

CK

21:41

Claudius Kehrhahn

@AndreasBaudis es ist beeindruckend mit welcher Konstanz, Energie und Herz du diese Gruppe moderierst und nun auch noch das Angebot einer Zoom Session zu MarketSurge, welches ich sehr gerne angenommen hätte, mich aber derzeit auf den PTC konzentriere. Vielen Dank 👏🙏💪🥳

👍

NS

J

HM

MG

21:45

Mike Gottlebe

In reply to this message

alarme generieren kann Plus auch. die formationserkennung basiert auf verschiedenen indikatoren für verschiedene formationen. wenn man also nicht nur ganz bestimmte formationen identifizieren möchte, sondern gleich einen ganzen haufen, dann sind die max 10 indikatoren von plus möglicher weise schon etwas knapp

❤

TW

21:45

video dazu z.B. hier: https://www.youtube.com/watch?v=XP2z6RRnLQg

RH

22:30

Reni Herzig

In reply to this message

Video file

Not included, change data exporting settings to download.

00:32, 2.8 MB

O

1 October 2024

A

08:07

Andreas

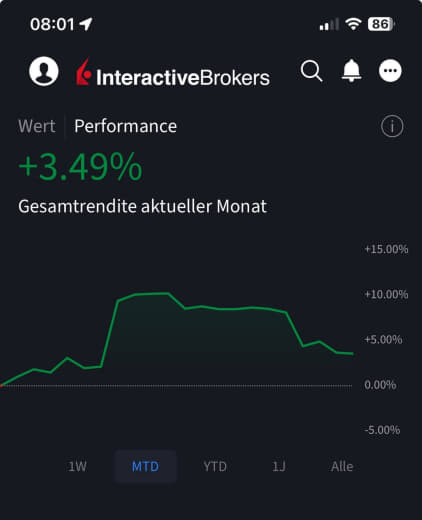

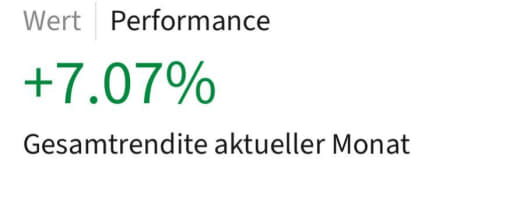

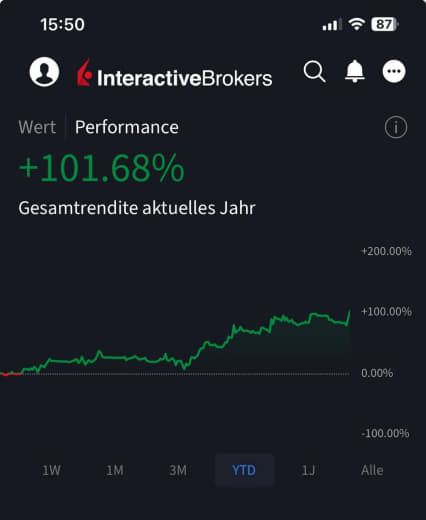

Performance September: nachdem das 1. Drittel bei 10 % lag wurde ich übermütig und wollte 30 % für den Monat. Kaum ausgesprochen, war's vorbei mit der glücklichen Hand. Aber immerhin: die 3 vorne ist's geworden und ich hab meine Bodenhaftung wieder zurück. 🤣

Wie habt Ihr Euch im September geschlagen?

👍

Wie habt Ihr Euch im September geschlagen?

NS

M

JL

PB

08:42

Patrick B.

Nach meinem großen Fall habe ich kurz mit aller Gewalt versucht nochmal was zu reißen und bin damit noch ein paar Stufen gefallen.

Jetzt lieber wieder etwas mit mehr Vorsicht, Überlegungen und entspannter, aber dafür steigen die % wieder.

Manchmal hilft es doch lieber wieder einfach zwei Schritte zurückzugehen als blind nach vorne zu stürmen 😂

Next Target for this Year: Beat the Market! 😎

❤

Jetzt lieber wieder etwas mit mehr Vorsicht, Überlegungen und entspannter, aber dafür steigen die % wieder.

Manchmal hilft es doch lieber wieder einfach zwei Schritte zurückzugehen als blind nach vorne zu stürmen 😂

Next Target for this Year: Beat the Market! 😎

O

CK

CL

08:44

Wichtigstes Learning: Der Markt entscheidet was er macht und man kann nur seine Strategie anpassen um mitzuschwimmen…

Mit Gewalt seine Strategie durchdrücken weil man denkt der Markt macht was ich will: Nein 😂

👍

Mit Gewalt seine Strategie durchdrücken weil man denkt der Markt macht was ich will: Nein 😂

M

CK

A

A

PB

08:50

Patrick B.

In reply to this message

Na klar 😁

Ihr kennt mich ja mittlerweile ... Ich teile alles mit euch ... ob Ihr wollt oder nicht 😂

❤

Ihr kennt mich ja mittlerweile ... Ich teile alles mit euch ... ob Ihr wollt oder nicht 😂

EH

RW

M

A

A

A

TG

16:23

T G

Schätz mal ne Mischung aus Arbeitsmarktdaten, Hafenarbeiterstreik und Naher Osten 🤷♂️

US

16:23

Uwe Strakeljahn

Es wurden mehr offene Stellen gemeldet als erwartet.

A

16:27

Andreas

In reply to this message

Der Abwärtsdruck fing aber direkt schon zur Eröffnung um 15:30 h an, während die offenen Stellen erst um 16.00 h veröffentlich wurden.

16:30

Die Mag 7 bekommen im Moment auch mehrheitlich was auf die Nase.

M

16:42

Mandy

Für mich als Neuling, was erreicht ihr durchschnittlich im Monat/ Jahr an Rendite?

A

16:45

Andreas

In reply to this message

Das ist super, herzlichen Glückwunsch. Was hast Du schwerpunktmäßig gehandelt?

M

16:46

Mandy

Ich habe eure ganzen Tipps und Ideen auf den Kryptomarkt adaptiert 😅

16:48

Keine Ahnung, ob das für diesen Markt gut oder durchschnittlich oder was auch immer ist 🤷🏻♀️

US

16:55

Uwe Strakeljahn

In reply to this message

Ich denke um 15:30 waren es einfach Gewinnmitnahmen, nachdem es gestern um 20:30 Uhr so steil noch hochging

A

17:00

Andreas

In reply to this message

Kryptos sind im Gegensatz zu Aktien viel volatiler, so dass man, wenn man richtig liegt schnell sehr gite Gewinne machen kann. Aber diese hohe Volatilität wirkt natürlich auch in die entgegengesetzte Richtung, so dass aus schnellen Gewinnen auch schnelle Verluste werden können.

👍

O

M

A

17:06

Andreas

In reply to this message

Aber wenn Du nur die Hälfte der September-Performance monatlich im Durchschnitt erwirtschaftest, bist schon sehr weit vorne dabei.

M

17:30

Mandy

In reply to this message

Mega 👍🏻 Das ist doch mal ein Ziel für mein 2. Jahr im Markt 💪🏻🍀

👍

A

M

17:30

Miky

Ich habe 0,42 % im Plus. Aber ich fahre seit ein paar Monaten nur das gleiche. Mit 8 Unternehmen halte ich und mit dem Kurs und der Dividende gewinne ich 😁

Im Paper teste ich gerade die neue Strategie

Im Paper teste ich gerade die neue Strategie

17:33

War bis 14.09. im Urlaub, kein Trade gemacht.

A

19:42

Andreas

Schätzfrage: mal angenommen am 01.02.2018 zahlt Ihr 206.000 USD auf das Depot ein und kauft davon am 14.02.2018 (Gesamt-Markt wechselt von gelb auf grün) 206 LURO-Aktien, je Aktie für 1.000 USD. Für den Kauf werden je Aktie 1 USD Transaktionskosten berechnet. Dividenden, Steuern, sonstige Kosten werden nicht berücksichtigt. Dann legt Ihr Euch schlafen und lasst die Aktien für sich selbst arbeiten, also buy & hold.

Was glaubt Ihr: wie hoch wäre heute der Wert des Depot´s?

😁 bin gespannt auf Eure Schätzungen

Was glaubt Ihr: wie hoch wäre heute der Wert des Depot´s?

😁 bin gespannt auf Eure Schätzungen

20:14

Depot 1 grün, das zweite rot… 😬… war nicht mein Monat. Wollte wohl zu viel… Mal sehen ob sich im Oktober was dreht…

A

M

20:41

Mandy

In reply to this message

Hmmm… der S&P500 hat ca 2,2x … LURO… mit b&h ca 3,5x ….bei deiner Performance… 6x??🤷🏻♀️ Keine Ahnung, mir fehlt für LURO die Erfahrung 😅🫣

s

20:47

schadn

Bestimmt 1.000.001 +x sonst hättest du das Rechenbeispiel nicht gemacht 😉

CK

20:50

Claudius Kehrhahn

Ich tippe mal etwas weniger 850T

JL

20:52

Jeannine Lietsch

Auf jeden Fall eine Zahl, die mich zum weinen bringt, weil ich nicht nach dem Abi mit investieren angefangen habe…

M

20:53

Mandy

Wie wahr … und mein Abi ist 30 Jahre her 🫣🤣

20:56

Ohha… in der Zeit hat der S&P500 schon alleine 6x gebracht… ich muss wohl bei Krypto bleiben, um die „verlorene“ Zeit wieder gut zu machen 🤔😅

A

22:34

Andreas

In reply to this message

Nicht gleich übertreiben, der S&P 500 hat sich seit Februar 2018 ca. verdreifacht.

M

23:15

Mandy

In reply to this message

Ja knapp, aber seit ich Abitur gemacht habe war‘s doch mehr… Das ist aber keine Diskussion wert. 😉

2 October 2024

A

US

00:25

Uwe Strakeljahn

In reply to this message

Meine Schätzung gemäß meiner Auswahl der Performance ergäbe ca. 1.600.000 USD

A

06:06

Andreas

In reply to this message

nicht nur einfach alle top-performer auswählen, das ist Selbstbetrug

US

06:41

Uwe Strakeljahn

In reply to this message

Ich habe nur mein Auswahl Kriterium von 36% Performance/Jahr gewählt und hochgerechnet. Wie die Performance zur Zeit von Corona und im Bärenjahr gewesen wäre, habe ich außer Acht gelassen. Ich habe keine spezielle Aktie gewählt. Einfach daran geglaubt, dass es eine Aktie gegeben hätte, die all dem gestrotzt hätte.

A

07:05

Andreas

Das ist Schönrechnen und führt zu einer falschen Erwartungshaltung.

US

07:45

Uwe Strakeljahn

In reply to this message

Du hast ja auch keine konkrete Vorgabe zur Schätzung angegeben. Irgendeine Luro-Aktie im Wert von 1000$, ein Startkapital in Höhe von 205794$ und ein Datum im Februar 2018. Da kann es überall zwischen 0 und meiner geschätzten Summe sein. Ich bin vom Optimalfall ausgegangen.

A

09:00

Andreas

In reply to this message

Bei 206 LURO-Aktien sind nicht nur Top-Performer dabei, sonder auch Low-Performer und viele Durchschnittsperformer. Im Prinzip ähnlich wie bei einem Index. Wenn Du natürlich erst mal ein Screenig machst und nur die Top-Performer als Basis nimmst, kommst Du zwangsläufig auf einen astronomisch hohen Wert. Das Problem dabei ist aber, dass die Top-Performer der letzten 5 Jahre nicht auch die Top-Performer der kommen 5 Jahre sein müssen, d.h. hier schürst Du eben eine falsche Erwartung.

Hinzu kommt, dass die Frage eine Schätz-Aufgabe war und keine: Screen mal durch, damit Du nur Top-Performer erwischst und rechne dann hoch. Schätzen heißt kurz überlegen, was ggfls. möglich sein könnte. Ich glaube alle anderen haben die Aufgabe verstanden, warum macht es der Ingenieur a.D. so kompliziert?

Hinzu kommt, dass die Frage eine Schätz-Aufgabe war und keine: Screen mal durch, damit Du nur Top-Performer erwischst und rechne dann hoch. Schätzen heißt kurz überlegen, was ggfls. möglich sein könnte. Ich glaube alle anderen haben die Aufgabe verstanden, warum macht es der Ingenieur a.D. so kompliziert?

09:03

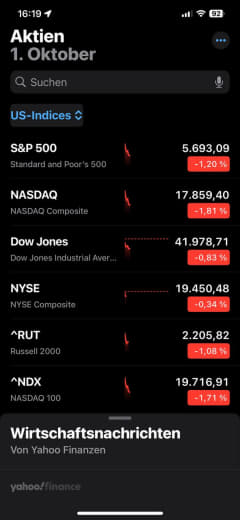

In reply to this message

🟢 🟢 🟢 US-Markets - The Big Picture 🟢 🟢 🟢

Heute mangels Zeit wieder nur die Kurzfassung:

- US-Handel gestern volatil

- alle Indices in rot, von leicht bis kräftig alles dabei

- Gesamt-Markt weiter im Aufwärtstrend

- Ausblick: weiter seitwärts mit Drang nach Süden

👍

Heute mangels Zeit wieder nur die Kurzfassung:

- US-Handel gestern volatil

- alle Indices in rot, von leicht bis kräftig alles dabei

- Gesamt-Markt weiter im Aufwärtstrend

- Ausblick: weiter seitwärts mit Drang nach Süden

ML

A

US

09:06

Uwe Strakeljahn

In reply to this message

Ich habe gedacht ich kaufe 206 Aktien von einem Underlying und nicht 206 unterschiedliche Underlyings.

NK

09:08

Nicole Keller

In reply to this message

Guter Punkt Andreas!

Mich würde interessieren, wenn man sich im jahr 2024 -5 Luro Aktien- ins Langzeitdepot legen möchte-was wären denn die auswahlkriterien?

- Geht man hier vor nach „unterbewerteten aktien“ (wobei das bei luros ja echt schwierig ist)

- welche unternehmenskennzahlen sind hier ausschlaggebend für eine gute Auswahl?

- Oder konzentriert man sich mehr auf aktien, die aktuell nicht zu den top performen gehören, weil das potenzial bereits ausgeschöpft ist?

Bei 206 luro aktien fällt es mir ein wenig schwer 5 zu wählen…

Mich würde interessieren, wenn man sich im jahr 2024 -5 Luro Aktien- ins Langzeitdepot legen möchte-was wären denn die auswahlkriterien?

- Geht man hier vor nach „unterbewerteten aktien“ (wobei das bei luros ja echt schwierig ist)

- welche unternehmenskennzahlen sind hier ausschlaggebend für eine gute Auswahl?

- Oder konzentriert man sich mehr auf aktien, die aktuell nicht zu den top performen gehören, weil das potenzial bereits ausgeschöpft ist?

Bei 206 luro aktien fällt es mir ein wenig schwer 5 zu wählen…

US

09:19

Uwe Strakeljahn

Ich habe ein anderes Kriterium für Luro-Aktien, als in der Beschreibung, die im anderen Chat beschrieben ist, um die Auswahl einzugrenzen. Die Performance ist bei mir höher als 0% in den einzelnen Zeiträumen und ich habe eine Marktkapitalisierung höher 1 Milliarde sowie Analystenrating von Kauf eingestellt. So erhalte ich weniger Aktien zur Wahl, die aber auch dann eine bessere Performance als der Rest hatten.

Im Moment werden mir 29 Luro-Aktientitel angezeigt.

Im Moment werden mir 29 Luro-Aktientitel angezeigt.

09:26

Meine überarbeitete Schätzung für das Depot von 206 Luro-Aktien-Titel: 300.000 $ von 2018 bis heute.

UH

10:56

Ulrich H

In reply to this message

Müsste der Markt dann nicht „gelb“ sein?

Und wie schätzt du die weltpolitische Situation ein?

Und wie schätzt du die weltpolitische Situation ein?

NK

11:19

Nicole Keller

gibt es irgendwo eine anleitung, wie man bei IB zusätzlich zum trading konto ein Langzeitdepot eröffnet? Sodass man gut unterscheiden kann, vielen dank.

MR

11:35

Marc Rüther

ich habe einfach bei dem Support von Captrader angerufen, ging recht flott

A

12:41

Andreas

In reply to this message

Erst wenn der SPX mind 0,5 % tiefer als der SMA 21 schließt geht das Big Picture auf gelb - eine harte Regel ohne Interpretationsspielraum, um emotional gesteuerte Fehler zu vemeiden.

Der Ausblick dagegen ist eher weich in seiner Wahrnehmung, d.h. ICH sehe hier noch einen Aufwärtstrend, der aber anfängt zu bröseln. Für den Aktienhandel heißt das für MICH: keine neuen Käufe, Bestand ggfls. reduzieren oder Stopp-Kurse enger an den aktuellen Kurs ziehen.

Die aktuelle Weltpolitik könnte der Auslöser für´s Bröseln des Aufwärtstrend sein, aber sicher kann man nicht sein. Ich gehe im Moment davon aus, dass sich die Situation im nahen Osten weiter verschärft und dies auch nachteilig für die US-Börsen ist. Die Charts werden es uns zeigen.

👍

Der Ausblick dagegen ist eher weich in seiner Wahrnehmung, d.h. ICH sehe hier noch einen Aufwärtstrend, der aber anfängt zu bröseln. Für den Aktienhandel heißt das für MICH: keine neuen Käufe, Bestand ggfls. reduzieren oder Stopp-Kurse enger an den aktuellen Kurs ziehen.

Die aktuelle Weltpolitik könnte der Auslöser für´s Bröseln des Aufwärtstrend sein, aber sicher kann man nicht sein. Ich gehe im Moment davon aus, dass sich die Situation im nahen Osten weiter verschärft und dies auch nachteilig für die US-Börsen ist. Die Charts werden es uns zeigen.

RB

N

ML

TT

TT

EH

13:37

E H

In reply to this message

Hi Mandy, mich interessiert hier welches Underlying du dafür nimmst? Kryptos direkt oder über etfs? Auf welcher Handelsplatform?

A

13:43

Andreas

In reply to this message

das ist ein Thema für die Nächste Zoom-Session, sonst wird das hier ein Roman.

👍

A

NK

3 October 2024

US

11:19

Uwe Strakeljahn

https://www.youtube.com/live/OZiJsla0dUs?si=fe_hcenardxGNWFm

Markus Koch hat gestern in seiner "Pseudo-Closing Bell" sehr interessante Hinweise zu den nächsten Wochen gegeben.

👍

Markus Koch hat gestern in seiner "Pseudo-Closing Bell" sehr interessante Hinweise zu den nächsten Wochen gegeben.

HM

A

CA

17:33

Christian Arriba

In reply to this message

Das wären dann ja 3*. Wenn der S&P in der Zeit schon 3* gemacht hat, schätze ich mal auf 1.2 Mio

E

19:57

Ele

In reply to this message

Hi Andreas, der Link ist nicht mehr gültig- würdest du nochmal einen neuen erstellen?

Danke und Liebe Grüße 👋

Danke und Liebe Grüße 👋

A

4 October 2024

C

E

12:50

ENNA 🌀

Kann mir von Euch jemand sagen, ob ich in der IB App (IBKR) eine OCA-Order eingeben kann?

Ich habe alles durchgesucht, aber nichts gefunden.

Auf den IB-Seiten wird auch nur der Vorgang für die TWS erklärt.

Bin auf Eure Tipps & Hinweise gespannt🤩.

Danke & lieben Gruß, Verena

Ich habe alles durchgesucht, aber nichts gefunden.

Auf den IB-Seiten wird auch nur der Vorgang für die TWS erklärt.

Bin auf Eure Tipps & Hinweise gespannt🤩.

Danke & lieben Gruß, Verena

RT

12:51

Robin Trapp

Dieses Feature erwarte ich sehnlichst 😂 Ich konnte es auch nicht finden und gehe davon aus, dass sie es noch nicht implementiert haben. Immerhin haben sie vor einiger Zeit Conditional Orders hinzugefügt

👍

E

A

13:15

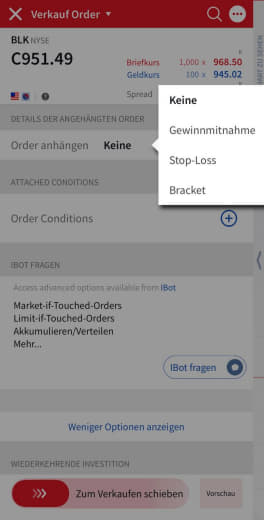

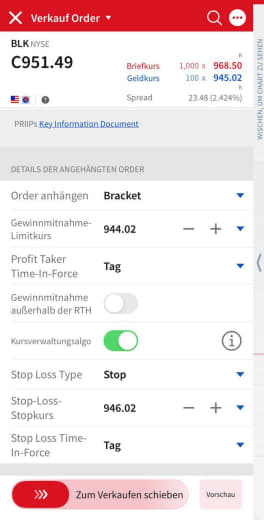

Andreas

In reply to this message

also eine Bracket-Order funktioniert, wenn Dir das ausreicht?

🙏

E

13:21

Wenn ihr auf Strategie beenden geht, lässt sich eine Gewinnmitnahme und Stopp-Loss-Order einstellen.

Ich habe es selbst noch nicht gemacht, aber ich denke das sollte dann eine OCA-Order sein.

Ich habe es selbst noch nicht gemacht, aber ich denke das sollte dann eine OCA-Order sein.

EK

13:29

Elke Klaus

Danke Uwe …

US

13:40

Uwe Strakeljahn

Übrigens wird uns die liebe Nicola auch noch Videos zum Thema Mobile-App erstellen. Dazu müsstet ihr noch einige Zeit warten, da noch andere Wünsche Vorrang haben.

E

14:05

ENNA 🌀

Danke für das Feedback und auch für den Screenshot, @AndreasBaudis .

Über Bracket-Order funktioniert das tatsächlich in der App …👍

Über Bracket-Order funktioniert das tatsächlich in der App …👍

A

14:25

Andreas

In reply to this message

🟢 🟢 🟢 US-Markets - The Big Picture 🟢 🟢 🟢

Heute wieder mangels Zeit die Kurzfassung:

- US-Börsen auch gestern weiter auf Richtungssuche

- zum Handelsschluss alle 6 Indices leicht bis solide im Minus, wobei sich NDQ und NDX noch am besten hielten

- Ausblick: weiter eher seitwärts mit leichtem Abwärtsdruck

🙏

Heute wieder mangels Zeit die Kurzfassung:

- US-Börsen auch gestern weiter auf Richtungssuche

- zum Handelsschluss alle 6 Indices leicht bis solide im Minus, wobei sich NDQ und NDX noch am besten hielten

- Ausblick: weiter eher seitwärts mit leichtem Abwärtsdruck

AH

AS

NS

14:37

Nicola Siebert

Hallo zusammen 😃,

ein neues YouTube-Video ist online.

Heutiges Thema - auf VIELFACHEN Wunsch:

Erster Einblick in den

Aktienscreener 2.0 - in TradingView - einfach und kurz erklärt

Zusätzlich hat Euch Benni eine großartige, kostenfreie, schriftliche Ausarbeitung zu dem vorgestellten Aktienscreener 2.0 erstellt.

Wir haben Euch unter dem YouTube-Video einen Link eingestellt. Wenn Ihr dort Eure E-Mail-Adresse hinterlasst, schicken wir Euch diese sehr gerne zu.

Und noch etwas in eigener Sache:

Wir freuen uns riesig, dass wir immer öfter gefragt werden, ob wir auch Schulungen anbieten. Für das Vertrauen an Euch alle ein GANZ herzliches Dankeschön 🙏.

Aufgrund dessen habe ich mir sehr wertvolle Unterstützung geholt und freue mich riesig darüber, dass Kerstin und Benni nun mit an Bord sind.

Ab sofort sind wir die Börsen Queens.

Auf Euren sehr oft erwähnten Wunsch hin sind wir gerade dabei, Online-Schulungen zu entwickeln.

Anfangen werden wir mit den Themen TraderWorkstation (TWS) und TradingView (TV) in verschiedenen Schwierigkeitsstufen.

Später werden dann noch weitere Themen dazukommen.

Mit dem o.g. Link könnt Ihr Euch ebenfalls zum Newsletter anmelden, um diesbezüglich auf dem Laufenden zu bleiben.

Wir wünschen Euch allen ein großartiges Wochenende 🌞.

Euer

Börsen Queens Team

👍

ein neues YouTube-Video ist online.

Heutiges Thema - auf VIELFACHEN Wunsch:

Erster Einblick in den

Aktienscreener 2.0 - in TradingView - einfach und kurz erklärt

Zusätzlich hat Euch Benni eine großartige, kostenfreie, schriftliche Ausarbeitung zu dem vorgestellten Aktienscreener 2.0 erstellt.

Wir haben Euch unter dem YouTube-Video einen Link eingestellt. Wenn Ihr dort Eure E-Mail-Adresse hinterlasst, schicken wir Euch diese sehr gerne zu.

Und noch etwas in eigener Sache:

Wir freuen uns riesig, dass wir immer öfter gefragt werden, ob wir auch Schulungen anbieten. Für das Vertrauen an Euch alle ein GANZ herzliches Dankeschön 🙏.

Aufgrund dessen habe ich mir sehr wertvolle Unterstützung geholt und freue mich riesig darüber, dass Kerstin und Benni nun mit an Bord sind.

Ab sofort sind wir die Börsen Queens.

Auf Euren sehr oft erwähnten Wunsch hin sind wir gerade dabei, Online-Schulungen zu entwickeln.

Anfangen werden wir mit den Themen TraderWorkstation (TWS) und TradingView (TV) in verschiedenen Schwierigkeitsstufen.

Später werden dann noch weitere Themen dazukommen.

Mit dem o.g. Link könnt Ihr Euch ebenfalls zum Newsletter anmelden, um diesbezüglich auf dem Laufenden zu bleiben.

Wir wünschen Euch allen ein großartiges Wochenende 🌞.

Euer

Börsen Queens Team

RB

MM

SS

MW

US

15:41

Uwe Strakeljahn

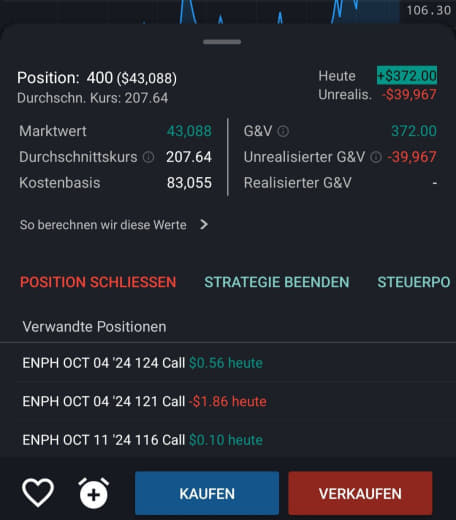

In reply to this message

Die Position ist im Echtgeld. Schon länger auf dem Level. Ich verkaufe regelmäßig Calls und nehme so Einnahmen ein.

Wenn der Zeitpunkt kommt Steuern zu sparen, werden die Verluste realisiert.

👍

Wenn der Zeitpunkt kommt Steuern zu sparen, werden die Verluste realisiert.

MW

A

19:02

Andreas

Wie macht man Gewinne mit Verlusten?

Das ergibt keinen Sinn!

Das ergibt keinen Sinn!

US

19:21

Uwe Strakeljahn

In reply to this message

Stimmt, mit Buchverlusten bei einem Aktien-Titel macht man kein Gewinn. Aber mit 10 anderen Aktien-Titel im Depot kann man Gewinne realisieren und dann die Verluste von dem einen Titel realisieren und so die Steuern beim Finanzamt auf Null im Aktientopf setzen. Was man zum Ende des Jahres machen sollte, wenn abzusehen ist, wieviel Gewinn man gemacht hätte ohne Verluste zu realisieren

M

HM

19:45

Herr Muth

Oder man realisiert sofort den Verlust, wenn die Position nicht mehr zum Trade passt und „trägt“ den Verlust im Topf steuerlich mit, bis Gewinne diesen auffüllen.

👍

G

A

US

19:54

Uwe Strakeljahn

In reply to this message

In einem Webinar von Philipp Jürgen Müller kurz vor Weihnachten im Jahr 2020 hat er es so empfohlen, wie ich es beschrieben habe, was auch mehr Sinn macht. Schließlich weiß man zur Hälfte des Jahres ja noch nicht, ob man auch genügend Gewinne macht um die Verluste auszugleichen. Der mentale Druck ist auch höher, wenn man gezwungen wird Gewinne zu machen, um die Verluste auszugleichen. Andersherum ist es mental leichter auszuhalten.

👍

E

A

20:17

Andreas

In reply to this message

Das Ziel des Business ist viele Steuern zu zahlen. Wenn man viele Steuern zahlt, hat man auch viel Gewinn gemacht (Ausnahme: Termingeschäfte als Privatperson).

Wenn XYZ behauptet, dass man mit solchen "Steuertricks" Geld verdient, ist das schlichtweg falsch.

Der Fokus MUSS auf dem Business liegen!

Wenn Du Dich fragst, warum Du bei der Performance nur meine Rücklichter siehst, liegt es genau an der falschen Denkweise!

👍

Wenn XYZ behauptet, dass man mit solchen "Steuertricks" Geld verdient, ist das schlichtweg falsch.

Der Fokus MUSS auf dem Business liegen!

Wenn Du Dich fragst, warum Du bei der Performance nur meine Rücklichter siehst, liegt es genau an der falschen Denkweise!

O

G

RB

20:18

In reply to this message

Daran erkennt man, dass der Gesamt-Markt aktuell keine gute Umgebung für neue Ideen ist!

HM

20:22

Herr Muth

Ich habe verstanden, dass nur die Steuerzahlung gestundet wird. (Weil man zunächst Verluste gegenrechnet).

US

20:23

Uwe Strakeljahn

In reply to this message

Ich denke hier sehen 547 Mitglieder deine Rücklichter.

Ich habe keine Probleme Steuern zu zahlen. Aber zunächst müssen die Verluste aus dem Aktientopf der Vorjahre ausgeglichen werden. Das ist zunächst mein Ziel. Ich zahle ja noch Steuern auf Stillhalter/Termingeschäften.

Ich fahre da schon zweigleisig.

Ich habe keine Probleme Steuern zu zahlen. Aber zunächst müssen die Verluste aus dem Aktientopf der Vorjahre ausgeglichen werden. Das ist zunächst mein Ziel. Ich zahle ja noch Steuern auf Stillhalter/Termingeschäften.

Ich fahre da schon zweigleisig.

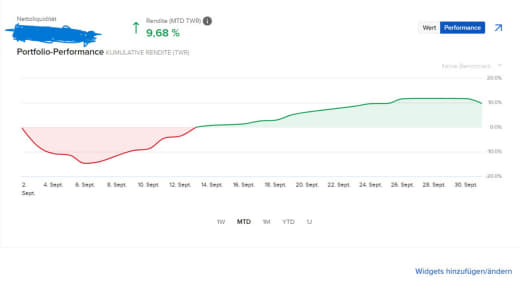

20:33

Aber mal was anderes:

Ich habe gerade gesehen, dass in der App von IBKR es nicht mehr möglich ist, seine Performance für den aktuellen Monat anzeigen zu lassen. Stattdessen wird jetzt 3 Monate als Auswahl angezeigt.

Ich habe gerade gesehen, dass in der App von IBKR es nicht mehr möglich ist, seine Performance für den aktuellen Monat anzeigen zu lassen. Stattdessen wird jetzt 3 Monate als Auswahl angezeigt.

A

20:40

In reply to this message

Da mittlerweile sehr wenige Mitglieder ihre Performance posten, kann ich das nicht beurteilen. Aber ich weiß, dass es Tausende Börsianer gibt, die um ein vielfaches bessere Performance machen als ich.

Es ist unerheblich, auf wie vielen Gleisen Du fährst, Du musst den Focus auf Dein Business legen, nicht auf Steuern!

Aus meiner Sicht verschwendest Du viel Zeit auf das, was nicht wichtig ist.

Der Mensch lernt auf 2 Arten: Einsicht oder Schmerzen. Wofür entscheidest Du Dich?

Es ist unerheblich, auf wie vielen Gleisen Du fährst, Du musst den Focus auf Dein Business legen, nicht auf Steuern!

Aus meiner Sicht verschwendest Du viel Zeit auf das, was nicht wichtig ist.

Der Mensch lernt auf 2 Arten: Einsicht oder Schmerzen. Wofür entscheidest Du Dich?

US

20:50

Uwe Strakeljahn

Ich bin auf der Seite der Einsicht. Ich habe auch keine Schmerzen. Ich habe den Focus auf das Business. Steuern stehen bei mir nur hinten an. Zur Zeit liegt mein Auge auf das Business mit Aktien. Da weiß ich, dass ich da noch die Performance nach oben drehen kann. Es läuft auch um ein Vielfaches besser als die letzten Jahre. Aber es geht noch was.

CE

21:04

Christoph Eling

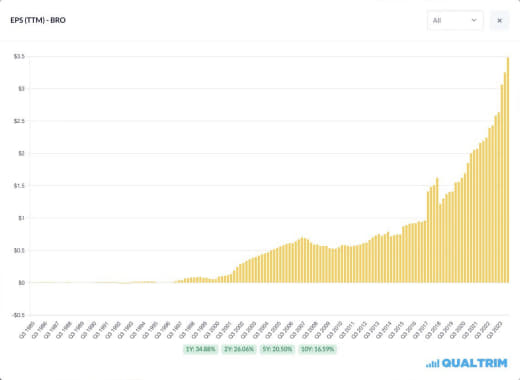

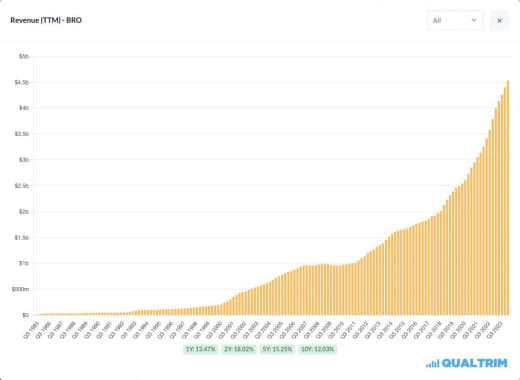

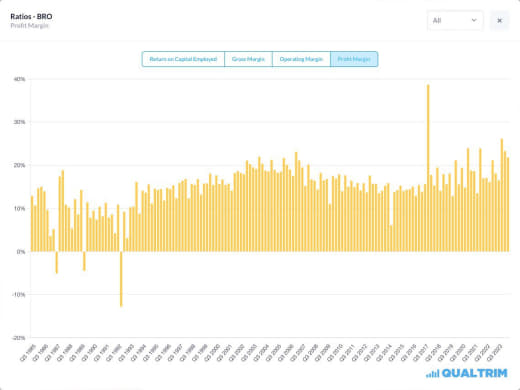

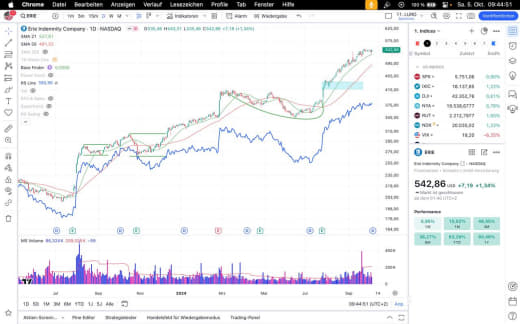

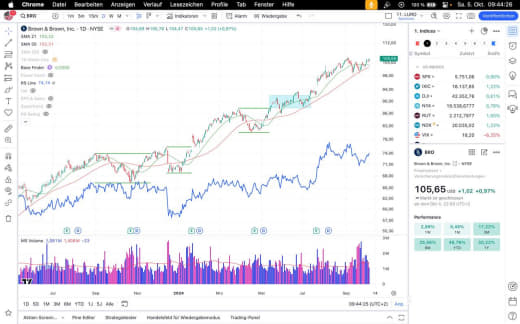

In reply to this message

Du kannst Dir ggf. mal BRO anschauen. Habe aber aktuell wenig Zeit alles hübsch aufzubereiten und in Worte zu fassen. Vielleicht werde ich Ideen einfach mal kurz und knapp aufnehmen, dass macht weniger Aufwand. 🤔

MW

21:08

Manu Walker

Ich mag Eure Diskussionen sehr. Am Ende haben wir alle ähnliche Ziele aber verfolgen ggf verschiedene Ansätze. Und es können unterschiedliche Wege ans Ziel führen.

Es ist super wenn jemand seine Meinung und seinen Ansatz teilt. Davon lebt die Gruppe. Weiter so! 👏

👍

Es ist super wenn jemand seine Meinung und seinen Ansatz teilt. Davon lebt die Gruppe. Weiter so! 👏

A

ML

SB

21:13

Also bei mir gibt es den Monat noch. Ich habe noch nie die Performance geteilt weil ich finde es bringt mich und andere nicht weiter.

Klar ist es motivierend zu sehen wenn jemand 100% im Jahr und mehr macht.

Jeder ist aber für sich in einer eigenen Situation und Phase. Das Blitzlicht der Performance eben nur ein Blitzlicht und selten der Beleg für ein auf Jahre etabliertes System. Daher fände ich es spannender die Systeme und Ansätze hinter einer guten Performance kennen zu lernen als die genaue relative Steigerungsrate zu kennen.

👍

Klar ist es motivierend zu sehen wenn jemand 100% im Jahr und mehr macht.

Jeder ist aber für sich in einer eigenen Situation und Phase. Das Blitzlicht der Performance eben nur ein Blitzlicht und selten der Beleg für ein auf Jahre etabliertes System. Daher fände ich es spannender die Systeme und Ansätze hinter einer guten Performance kennen zu lernen als die genaue relative Steigerungsrate zu kennen.

L

A

J

US

21:17

Uwe Strakeljahn

In reply to this message

Ich meinte nicht die Performance von 1 Monat, sondern die Performance vom aktuellen Monat (MTD) ist nicht mehr vorhanden.

MW

A

21:31

Angela

Mal eine Anfängerfrage: wo kann ich denn die meine Performance anschauen? Ich bin bei Captrader.

Liebe Grüße

Angela

Liebe Grüße

Angela

CP

22:14

Christian Preier

Ich wollte auch gerade mal nachschauen.

Ich hoffe, ich habe es richtig gemacht.

In der TWS auf Analysetools, dann ganz nach unten auf PortfolioAnalyst.

Dann öffnet sich im Browser Interactive Brokers.

Dort ist dann das Dashboard geöffnet.

Liebe Grüße

Christian

Ich hoffe, ich habe es richtig gemacht.

In der TWS auf Analysetools, dann ganz nach unten auf PortfolioAnalyst.

Dann öffnet sich im Browser Interactive Brokers.

Dort ist dann das Dashboard geöffnet.

Liebe Grüße

Christian

A

5 October 2024

A

08:33

Andreas

In reply to this message

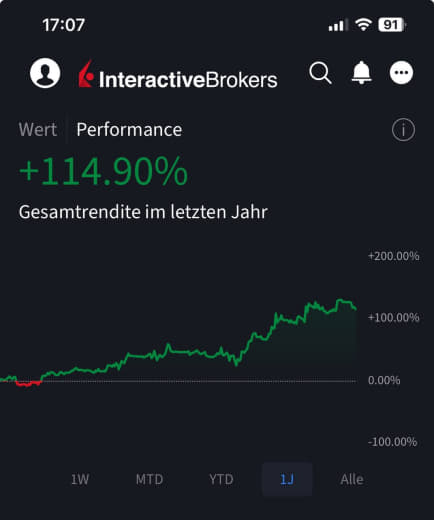

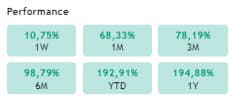

Ich finde das Teilen von Performance sehr wichtig, damit man weiß, wem man welche Fragen stellen muss, um sein eigenes Handeln zu verbessern. Diese Gruppe hier ist entstanden, weil wir unsere Performance mal verglichen haben und ich wissen wollte, wie der Thomas das macht, was er dann in der ersten Zoom-Session erklärt hat. Seine sehr einfache Herangehensweise hat mich zum Beispiel viel darüber nachdenken lassen, wie man Investitionen in LUROs vereinfachen kann, um dafür nicht so viel Lebenszeit zu verschwenden.

Oder ein anderes Beispiel:

Trader A macht recht konstant ca. 10 % pro Monat, somit ca. 120 % pro Jahr.

Trader B macht auch 120 % pro Jahr, aber in manchen Monaten überdurchschnittlich viel, in anderen Monaten gar nichst oder minimale Verluste.

Beide können voneinander lernen, wenn sie die richtigen Fragen stellen und hier hilft die Performance als Chart enorm weiter.

Man darf das Vergleichen der Performance nicht als Angeberei verstehen, sondern als Chance.

👍

Oder ein anderes Beispiel:

Trader A macht recht konstant ca. 10 % pro Monat, somit ca. 120 % pro Jahr.

Trader B macht auch 120 % pro Jahr, aber in manchen Monaten überdurchschnittlich viel, in anderen Monaten gar nichst oder minimale Verluste.

Beide können voneinander lernen, wenn sie die richtigen Fragen stellen und hier hilft die Performance als Chart enorm weiter.

Man darf das Vergleichen der Performance nicht als Angeberei verstehen, sondern als Chance.

CB

AS

RB

M

08:36

Mandy

Genau so ist es. Sonst weiß ich ja gar nicht, wen ich am besten fragen kann. 😉🥰

08:38

Ich möchte ja von den 15% die es auf die Reihe bekommen lernen und nicht von den 85% die mehr nur drüber reden 😉☺️

👍

D

SB

C

US

08:40

Uwe Strakeljahn

In reply to this message

Das stimmt schon. Aber was hilft mir zu wissen, wie die Performance einzelner Personen ist, wenn ich nicht weiß mit welchen Strategien die Person die Performance erreicht hat und nicht sein Trading-Journal vorzeigt, aus dem man die guten wie auch schlechten Trades erkennen kann.

A

09:02

Andreas

In reply to this message

das ist eine der Themen, die wir im kommenden Zoom-Meeting aufgreifen wollten und ich nach Freiwilligen gefragt habe, die mal Ihre Vorgehensweise detailliert zeigen, wenn ein Trade funktioniert und wenn er nicht funktioniert.

Leider haben sich nur 2 Personen gemeldet. 😢

Leider haben sich nur 2 Personen gemeldet. 😢

US

09:03

Uwe Strakeljahn

In reply to this message

Gibt es schon ein Termin für ein Zoom-Meeting? Ich würde mich auch bereit erklären, wenn es terminlich passt

A

09:41

Andreas

In reply to this message

Nein, noch keinen Termin, aber jetzt eine 3. Person auf der Freiwilligen-Liste. 👍

👍

ML

UH

US

09:42

Uwe Strakeljahn

In reply to this message

Nur zur Info vom 26. Oktober bis 7. Dezember stehe ich nicht zur Verfügung, da ich im Urlaub bin

❤

HM

UH

A

09:48

Andreas

In reply to this message

Alternative ERIE (auch Versicherungs-Branche) finde ich interessanter, weil höhere relative Stärke ⬇️⬇️⬇️

👍

HM

NK

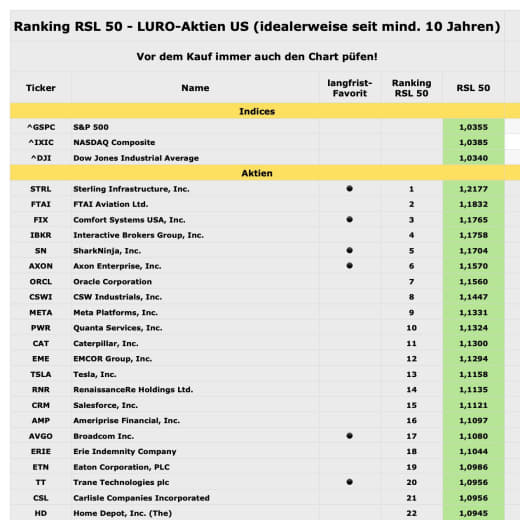

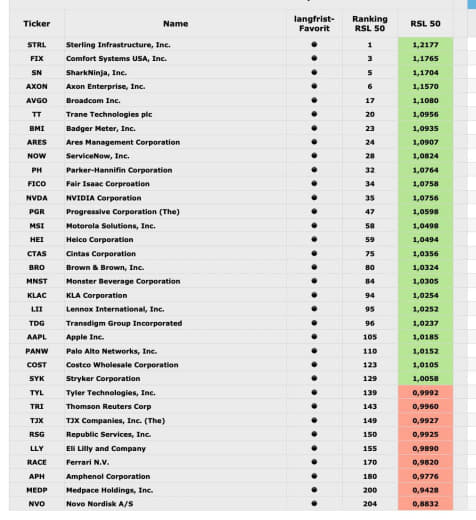

11:04

Nicole Keller

In reply to this message

@AndreasBaudis: bin gerade an dem buch zur richtigen Zeit im richtigen markt, jetzt aber etwas verwirrt 😂

Ich habe in der luro gruppe von dir schon einiges zur relativen stärke gelernt.

- Es gibt die relative stärke, die RS Zahl, die am besten über 70 sein sollte, auch bei dir immer in den Charts zu sehen

- dann gibts den RSI Wert auch irgendwo um die 70+, wo angibt ob über- oder unterverkauft, Indikator bei PJM kennengelernt (Schnittpunkt)

- und jetzt lese ich in dem buch noch was von einem RS-Wert bzw. RSL der um die 1 liegt.

Meine frage: was ist denn nun der unterschied zwischen dem RS Wert um die 70+ und dem RSL Wert um die 1?

Herzlichen Dank!

Ich habe in der luro gruppe von dir schon einiges zur relativen stärke gelernt.

- Es gibt die relative stärke, die RS Zahl, die am besten über 70 sein sollte, auch bei dir immer in den Charts zu sehen

- dann gibts den RSI Wert auch irgendwo um die 70+, wo angibt ob über- oder unterverkauft, Indikator bei PJM kennengelernt (Schnittpunkt)

- und jetzt lese ich in dem buch noch was von einem RS-Wert bzw. RSL der um die 1 liegt.

Meine frage: was ist denn nun der unterschied zwischen dem RS Wert um die 70+ und dem RSL Wert um die 1?

Herzlichen Dank!

TT

A

11:46

Andreas

In reply to this message

Der Relative Strength Index RSI misst die Stärke einer Kursbewegung der Aktie auf Basis der Kursdaten von zurückliegenden x Tagen der gleichen Aktie. Dadurch entsteht eine auf- und abschwellende Bewegung (Oszillator) zwischen 1 und 100. Ein Wert von 70 gilt allgemein als überkauft, ein Wert von 30 als überverkauft. Ich kann dem RSI nichts abgewinnen oder habe mich vielleicht auch noch nicht ausreichend damit beschäftigt.

Die RS-Line im Chart zeigt die Kursbewegung der Aktie im Verhältnis zu einem Index, meist der S&P 500 an. Hat die RS-Line einen steigenden Trend, ist die Performance besser als der Index, bei einem fallenden Trend ist die Performance schlechter als der Index.

Die Relative Stärke als Zahl im Chart neben der RS-Linie gibt an, welche Rangstelle die Aktie im Verhältnis zu allen anderen Aktien am US-Markt auf Basis der relativen Stärke hat, wobei 1 die schwächste Aktien sind und 99 die stärksten. Somit lassen sich mehrere Aktien hinsichtlich Ihrer relativen Stärke im Gesamtfeld aller Aktien vergleichen.

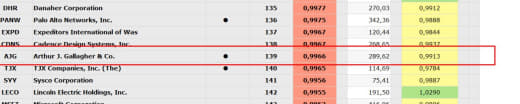

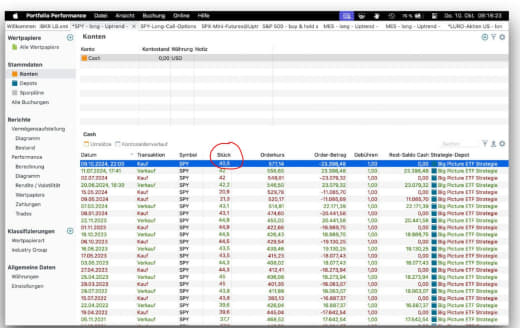

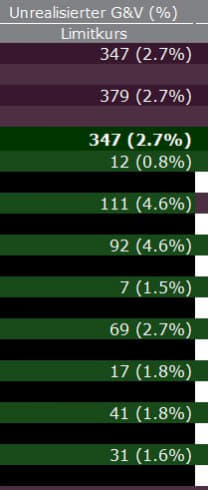

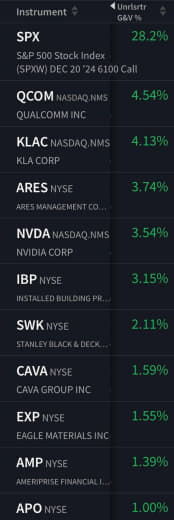

Eine andere Form der relativen Stärke kann man auch selbst berechnen, wie im Buch "Zur richtigen Zeit im richtigen Markt" beschrieben. Dabei dividiert man einfach den aktuellen Kurs durch den einfachen Durchschnitt der letzten x Tage. Liegt der Wert über 1 bedeutet das, dass der aktuelle Kurs der Aktie sich über dem Durchschnitt befindet, liegt der Wert unter 1, liegt der aktuelle Kurs unter dem Durchschnitt. Welchen Nutzen hat das? Im Chart kann man sich zum Beispiel den SMA 50 als Indikatoer einblenden und somit schnell feststellen, ob sich die Aktie über oder unter dem Durchschnitt befindet. Liegt die Aktie über dem Durchschnitt bedeutet das, dass die Aktie aktuell besser performat, als im Durchschnitt der letzten 50 Tage. Liegt die Aktie unter dem SMA 50 performt sie schelchter, als im Durchschnitt der letzten 50 Tage. Will man nun mehrere Aktien hindsichtlich Ihrer Stärke im Verhältnis zum SMA 50 beurteilen, greift man auf die realtive Stärke wie beschrieben berechnet zurück und kann somit feststellen, welche Aktie gegenüber ihrem eigenen SMA 50 am besten bzw. am schlechtesten performt. Tabellarisch Sortiert sieht das dann zum Beispiel so aus. ⬇️⬇️⬇️

❤

Die RS-Line im Chart zeigt die Kursbewegung der Aktie im Verhältnis zu einem Index, meist der S&P 500 an. Hat die RS-Line einen steigenden Trend, ist die Performance besser als der Index, bei einem fallenden Trend ist die Performance schlechter als der Index.

Die Relative Stärke als Zahl im Chart neben der RS-Linie gibt an, welche Rangstelle die Aktie im Verhältnis zu allen anderen Aktien am US-Markt auf Basis der relativen Stärke hat, wobei 1 die schwächste Aktien sind und 99 die stärksten. Somit lassen sich mehrere Aktien hinsichtlich Ihrer relativen Stärke im Gesamtfeld aller Aktien vergleichen.

Eine andere Form der relativen Stärke kann man auch selbst berechnen, wie im Buch "Zur richtigen Zeit im richtigen Markt" beschrieben. Dabei dividiert man einfach den aktuellen Kurs durch den einfachen Durchschnitt der letzten x Tage. Liegt der Wert über 1 bedeutet das, dass der aktuelle Kurs der Aktie sich über dem Durchschnitt befindet, liegt der Wert unter 1, liegt der aktuelle Kurs unter dem Durchschnitt. Welchen Nutzen hat das? Im Chart kann man sich zum Beispiel den SMA 50 als Indikatoer einblenden und somit schnell feststellen, ob sich die Aktie über oder unter dem Durchschnitt befindet. Liegt die Aktie über dem Durchschnitt bedeutet das, dass die Aktie aktuell besser performat, als im Durchschnitt der letzten 50 Tage. Liegt die Aktie unter dem SMA 50 performt sie schelchter, als im Durchschnitt der letzten 50 Tage. Will man nun mehrere Aktien hindsichtlich Ihrer Stärke im Verhältnis zum SMA 50 beurteilen, greift man auf die realtive Stärke wie beschrieben berechnet zurück und kann somit feststellen, welche Aktie gegenüber ihrem eigenen SMA 50 am besten bzw. am schlechtesten performt. Tabellarisch Sortiert sieht das dann zum Beispiel so aus. ⬇️⬇️⬇️

TT

HS

US

12:49

Uwe Strakeljahn

Wer sich intensiver mit den Indikatoren, Oszillatoren und Analyse-Tools befassen möchte, dem empfehle ich das Buch: "Technische Analyse der Finanzmärkte" von John J. Murphy. Dort werden auch der RSI (relative Stärke Index) sowie die Relative-Stärke- oder auch Ratio-Analyse genannt, erklärt.

👍

TT

M

NK

M

M

17:33

Miky

Momentan ist mein Bart länger als meine Rendite. Zumindest im Echt Geld

Ich teste gerade eine Strategie im Paper und wenn ich damit Erfolg habe, zeige ich sie euch gerne 😁

Um was es ungefähr geht, habt ihr in meiner damals erstellten PDF lesen können.😉

Ich teste gerade eine Strategie im Paper und wenn ich damit Erfolg habe, zeige ich sie euch gerne 😁

Um was es ungefähr geht, habt ihr in meiner damals erstellten PDF lesen können.😉

17:34

Momentan habe ich 4 Trades am laufen und CACI ist Spitzenreiter

👍

SB

A

19:26

Andreas

In reply to this message

Video file

Not included, change data exporting settings to download.

04:00, 71.6 MB

Zum Wochenende 🤘

US

CE

19:45

Christoph Eling

In reply to this message

Tatsächlich finde ich BRO sehr deutlich attraktiver (im Rahmen eines LURO-Depots). Sehe BRO sowohl fundamental vorne (besserer FCF Yield, beständigere Umsätze, bessere Margen) als auch technisch, da BRO im Wochenchart nicht weit in der Bewegung ist und ich ja gerade den hoffentlich kommenden Ausbruch dort als geeignet Einstieg ansehen würde, der einen recht klaren Invalidationspunkt für meinen Stop hätte.

CE

20:22

Christoph Eling

In reply to this message

In meinen Augen bietet sich nicht für jeden Handelsstiel und jedes Handelsziel ein so frequenter Abgleich von Depotentwicklungen an. Wenn ich mit einer langfristigen Strategie in einem Monat keinen Trade oder halt sehr wenige hatte, dann hat dieser Zeitraum wenig Aussagekraft im Vergleich zum Intraday-Händler der ggf. eine dreistellige Anzahl hatte und somit auch ein eher belastbares Ergebnis.

Dazu kommt noch das das Margin-Thema. Jemand, der konservativ mit einem Hebel von sehr deutlich unter 1 handelt, wird andere Prozente ausweisen als jemand, der sehr deutlich mit einem Hebel über 1 handelt.

Ich persönlich fände Kennzahlen wie Trefferquote in Kombination mit Profitfaktor und Verhältnis von durchschnittlichem Gewinn zu durchschnittlichem Verlust interessanter - ggf. noch Drawdowns dazu.

👍

Dazu kommt noch das das Margin-Thema. Jemand, der konservativ mit einem Hebel von sehr deutlich unter 1 handelt, wird andere Prozente ausweisen als jemand, der sehr deutlich mit einem Hebel über 1 handelt.

Ich persönlich fände Kennzahlen wie Trefferquote in Kombination mit Profitfaktor und Verhältnis von durchschnittlichem Gewinn zu durchschnittlichem Verlust interessanter - ggf. noch Drawdowns dazu.

AW

J

TG

PB

23:09

Patrick B.

In reply to this message

Haha! Das mit dem Bart und CACI kann ich genauso unterschreiben 😂

M

s

6 October 2024

A

A

08:04

Andreas

In reply to this message

Schneidet doch Eure Bärte einfach ab, dann liegt die Rendite wieder vorne. 😁

PB

08:13

Patrick B.

In reply to this message

Niemals! 😂😂

Da feile ich lieber an der Rendite … das ist einfacher 🤭

Da feile ich lieber an der Rendite … das ist einfacher 🤭

A

08:27

Andreas

In reply to this message

Was die Kennzahlen angeht bin ich bei Dir, jedoch müsste man hier erst einmal einen Standard definieren, welche Kennzahlen zu einem Performance-Posting dazu gehören sollen und wie im Detail die Kennzahlen berechnet werden. So entspricht zum Beispiel das geplante CRV einer Strategie nicht dem CRV aller gehandelten Trades dieser Strategie. Das wird dann schon sehr aufwendig. Aber vielleicht kann ja jemand mal eine Checkliste entwerfen, mit der man monatlich eben diese Zahlen überprüfen kann, auch jeder für sich selbst.

Hinsichtlich des Performancevergleichs untereinander ist ein monatlicher Abgleich aus meiner Sicht durchaus praktikabel, jedoch nicht nur im Vergleich des letzten Monats, sondern auch für die letzten 12 Monate. Dann ist auch die Aussagekraft von höherer Qualität.

❤

Hinsichtlich des Performancevergleichs untereinander ist ein monatlicher Abgleich aus meiner Sicht durchaus praktikabel, jedoch nicht nur im Vergleich des letzten Monats, sondern auch für die letzten 12 Monate. Dann ist auch die Aussagekraft von höherer Qualität.

HS

M

CE

09:00

Christoph Eling

In reply to this message

Man kann sich aktuell auch mal wieder mit Lotus Bakeries auseinandersetzen und ggf. auf einen Ausbruch über das Hoch der letzten Wochen setzen.

US

09:01

Uwe Strakeljahn

In reply to this message

Wenn der Preis nicht so hoch wäre, sicherlich interessant.

CE

09:02

Christoph Eling

In reply to this message

Gegebenenfalls halt Bruchstücke kaufen, wenn es der eigene Broker zulässt. Aber ja, wenn das nicht geht, dann ist das ein Punkt.

A

09:09

Andreas

Hallo alle Zusammen, wie ist Eure Börsenstimmung für die Wall Street aktuell?

Bitte nur abstimmen, nicht kommentieren.

Bitte nur abstimmen, nicht kommentieren.

Final results

- eher bullish 👍 27 votes

- eher neutral oder seitwärts ⚖️ 34 votes

- eher bearish 👎 4 votes

- ch kann mich nicht entscheiden 🫣 2 votes

67 votes

US

09:09

Uwe Strakeljahn

In reply to this message

Das würde gehen, aber ist bei Teilgewinnmitnahme eine Rechnerei. Eine andere vielleicht einfachere Möglichkeit wäre es über Optionen zu handeln. Da ist der Geldeinsatz nicht so hoch und man kann die möglichen Verluste gut steuern.

HM

10:10

Herr Muth

In reply to this message

Cooler Vergleich. Vielleicht eine eher Kurzfristig, die andere eher mittelfristig. 😎

Danke euch beiden.

Danke euch beiden.

A

US

10:36

Uwe Strakeljahn

In reply to this message

Auf welche Art hast du die 206 Aktien ausgewählt? Bist du vom jetzigen Stand ausgegangen und hast rückwärts gerechnet? Waren diese Aktien denn schon im Jahr 2018 als LURO-Aktien erkennbar?

s

10:38

schadn

Viel spannender ist doch die Frage, welche Aktien sollten wir heute kaufen? Kannst die Liste Mal einstellen😉

❤

RS

O

US

10:47

Uwe Strakeljahn

Den Top-Wert SMCI hätte ich im Leben nicht am 14. Februar 2018 gekauft. Da war die Aktie auf Kurs Richtung Süden und von künstlicher Intelligenz als Zukunftsinnovation haben mal gerade ein paar "Spinner" erzählt.

10:51

Ich denke die Wahrheit des erreichbaren liegt zwischen dem Ergebnis und dem was der S&P500 erreicht hat. Ein Vergleich zum Russell 2000 wäre noch interessant, da sicherlich einige dieser Titel dort im Jahr 2018 noch vertreten waren oder auch noch sind.

A

11:13

Andreas

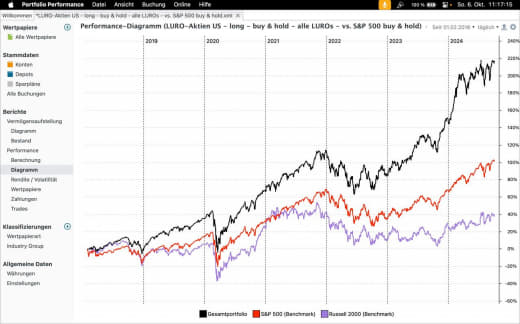

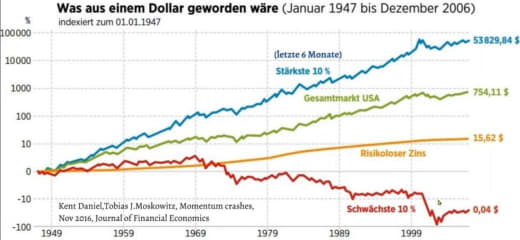

Grundsätzlich muss man Backtests immr sehr kritisch betrachten, da sich die Performance nicht zwangsläufig auch in der Zukunft so fortschreiben muss. Der Grund für den Test ist herauszufinden, welche Eigenschaften auf rein charttechnischer Basis die großen Gewinner vom Durchschnitt unterscheidet und der buy & hold Test war nur der erste Schritt.

Konkret bei diesem Test gab es nur 1 Timing-Komponente, nämlich der Beginn eines Aufwärtstrends. So etwas würde man in der Praxis wohl eher nicht machen.

Die Auswahl der 206 Aktien kam wie folgt zustande: wir hatten zu Beginn unserer LURO-Community eine ganze Reihe von Aktien zusammen getragen, die Liste enthält aktuell 246 Aktien. Diese Liste habe ich mir nur im Monats-Chart angesehen und Aktien entfernt, die aus meiner subjektiven Sicht keine LURO´s sind. Die nun getesteten 206 Aktien haben überwiegend seit 10 Jahren LURO-Charakter, mind. aber 5 Jahre.

SCMI: wir hatten im Februar/März diesen Jahres viel über diese Aktie gepostet, man könnte sagen, sie war ein Cummunity-Liebling. Alle die dabei waren, freuten sich über die guten Gewinne, wer nicht dabei war, ärgerte sich. Seit dem Hoch im März bei knapp 123 USD ist die Aktie mittlerweile über 60 % nach Süden gezogen und sieht im Moment so gar nicht LURO aus. Das beweist,. dass auch jede LURO-Aktie, die gerade einen Lauf hat, jederzeit unter die Räder kommen kann. Ist NVDA der nächste Kandidat? Vielleicht. Hierfür braucht es also ein funktionierendes Timing-Modell.

Gewinner-LURO´s von morgen: wie vermutlich jeder andere auch, habe auch ich meine persönlichen Favoriten unter den LURO´s - Liste kommt gleich noch.

Der Vergleich zum Russell 2000 folgt auch gleich noch.

Konkret bei diesem Test gab es nur 1 Timing-Komponente, nämlich der Beginn eines Aufwärtstrends. So etwas würde man in der Praxis wohl eher nicht machen.

Die Auswahl der 206 Aktien kam wie folgt zustande: wir hatten zu Beginn unserer LURO-Community eine ganze Reihe von Aktien zusammen getragen, die Liste enthält aktuell 246 Aktien. Diese Liste habe ich mir nur im Monats-Chart angesehen und Aktien entfernt, die aus meiner subjektiven Sicht keine LURO´s sind. Die nun getesteten 206 Aktien haben überwiegend seit 10 Jahren LURO-Charakter, mind. aber 5 Jahre.

SCMI: wir hatten im Februar/März diesen Jahres viel über diese Aktie gepostet, man könnte sagen, sie war ein Cummunity-Liebling. Alle die dabei waren, freuten sich über die guten Gewinne, wer nicht dabei war, ärgerte sich. Seit dem Hoch im März bei knapp 123 USD ist die Aktie mittlerweile über 60 % nach Süden gezogen und sieht im Moment so gar nicht LURO aus. Das beweist,. dass auch jede LURO-Aktie, die gerade einen Lauf hat, jederzeit unter die Räder kommen kann. Ist NVDA der nächste Kandidat? Vielleicht. Hierfür braucht es also ein funktionierendes Timing-Modell.

Gewinner-LURO´s von morgen: wie vermutlich jeder andere auch, habe auch ich meine persönlichen Favoriten unter den LURO´s - Liste kommt gleich noch.

Der Vergleich zum Russell 2000 folgt auch gleich noch.

11:19

In reply to this message

Ich bin davon überzeugt, dass ein Ergebnis noch deutlich über dem der buy & hold Strategie liegt, wenn man Aktien gut auswählt und ein gutes Timing hinbekommt

❤

M

CP

PB

19:42

Patrick B.

In reply to this message

Ich oute mich mal als Mega fauler Mensch: willst du die Liste als Kopierbare Tickersymbole teilen! 😇

Ich finde die Mega und würde meine damit mal „updaten“ 😁

Ich finde die Mega und würde meine damit mal „updaten“ 😁

M

19:52

Mandy

Das wäre mega 😁

DH

19:57

Dirk Hellstern

In reply to this message

Eine Schere ✂️ und schnitt könnte ich freiwillig übernehmen 🙈

😁

PB

A

20:03

Andreas

In reply to this message

Die komplette Liste mit 207 Aktien oder nur meine Favoriten? Bedenke: meine Favoriten sind sehr subjektiv ausgewählt, also nicht gedankenlos übernehmen

s

20:04

schadn

Wie hast die denn subjektiv ausgewählt? AJG zb würde ich spontan noch dazu nehmen

M

PB

20:05

Patrick B.

In reply to this message

Für mich persönlich reichen deine Favoriten.

Und bzgl. Subjektiv und gedankenlos: deine Performance lässt mich soweit vertrauen, dass deine Favoriten jetzt nicht die schlechteste Wahl sein können 😜

👍

Und bzgl. Subjektiv und gedankenlos: deine Performance lässt mich soweit vertrauen, dass deine Favoriten jetzt nicht die schlechteste Wahl sein können 😜

M

RB

A

20:07

Ist natürlich mit gewissen Humor gemeint und ich weiß selbstverständlich wie du das meinst 😂

Aber in der Tat brauchen meine LuRo-Favoriten (ca. 30 Stück) mal ein Update … da kommt das wie gerufen 😇

👍

Aber in der Tat brauchen meine LuRo-Favoriten (ca. 30 Stück) mal ein Update … da kommt das wie gerufen 😇

DH

L

A

20:14

Andreas

In reply to this message

so subjektiv ausgewählt, dass ich AJG tatsächlich gar nicht in der Liste habe - so kann es passieren

Aber noch mal zur Auswahl: ich habe mir lediglich den Monatschart auf mind. 10 Jahre angesehen und sofern der Chart für mich einigermaßen harmonisch aussieht, habe ich diese Aktien favorisiert. Ich bin mir sicher, dass die Auswahl heute schon wieder anders aussehen würde, weil die Sichtweise immer auch emotional geprägt ist.

Aber noch mal zur Auswahl: ich habe mir lediglich den Monatschart auf mind. 10 Jahre angesehen und sofern der Chart für mich einigermaßen harmonisch aussieht, habe ich diese Aktien favorisiert. Ich bin mir sicher, dass die Auswahl heute schon wieder anders aussehen würde, weil die Sichtweise immer auch emotional geprägt ist.

s

20:20

schadn

OK, dachte das hat sich auf die Schätzfrage bezogen. Alles klar, danke

M

20:27

Mandy

Was war eigentlich die Antwort auf die Schätzfrage? 🤔

PB

A

s

20:54

schadn

Danke, Andreas jetzt hab ich wenigstens noch ne Aufgabe am Sonntag Abend😂

😁

A

A

21:03

Andreas

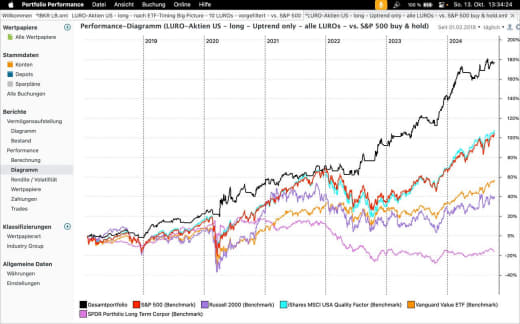

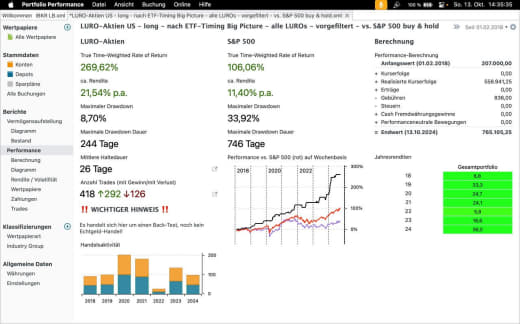

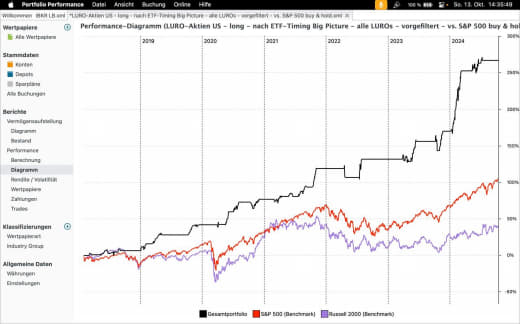

Eine neue LURO-Schätzaufgabe ☺️:

- die gleiche LURO-Liste mit 206 Aktien wie zuvor

- Einzahlung wie zuvor: 206.000 USD am 01.02.2018

- Trade-Beginn: 14.02.2018 mit jeweils 1.000 USD je Aktie inkl. 1 USD Transaktionskosten

- Kaufsignal: Wechsel Big Picture auf grün

- Verkaufssignal: Wechsel Big Picture auf gelb

- das Konto ist also entweder voll investiert oder nicht investiert

- realisierte Gewinne werden re-investiert

Welchen Wert hat das Handelskonto heute?

Spoiler: es sind über 10.000 Round-Trades!

- die gleiche LURO-Liste mit 206 Aktien wie zuvor